in the legal profession.

in the legal profession.

in the legal profession.

our values

Who We Are

The Dallas Women Lawyers Association is a non-profit organization uniting for the mutual benefit of women attorneys to elevate the standing of women in the legal profession.

calendar

Upcoming Events

27

Mar

Wed

01

May

Wed

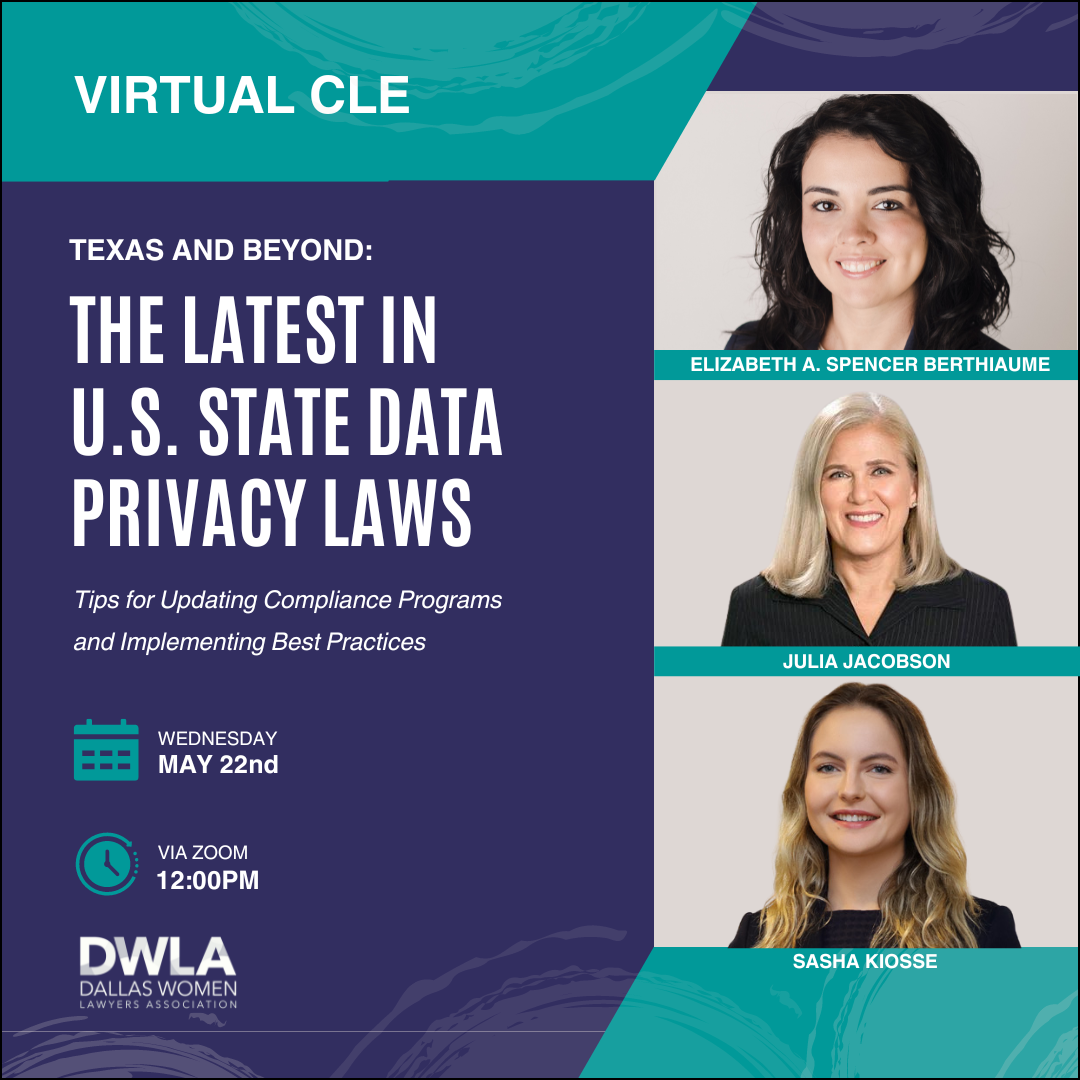

22

May

Wed

Elevate With DWLA

Become a Member

Membership with DWLA is open to both women and men in law, government employees and the judiciary.

Get Involved

DWLA offers a variety of programs and social activities to the legal community and professional women.

Partner With DWLA

Elevate your brand while empowering women in law. Discover sponsorship opportunities with DWLA.

Career Opportunities

Promoting diversity and inclusion in the legal profession – Find talent or find the next step in your career.

Through the Lens of DWLA

Social Stream

Thank You to Our Sponsors